29 October 2021

The relationship between ESG oversight and performance

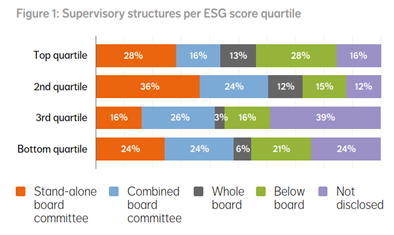

Glass Lewis and NN Investment Partners (NN IP) recently published a study of 129 global issuers examining the link between companies’ ESG supervisory structures and their performance relating to ESG factors. The report found that companies with stand-alone board committees to oversee environmental, social and governance (ESG) matters, tend to demonstrate better ESG performance than companies where ESG oversight is carried out by the full board or integrated into other existing committees.

The study covers companies in Europe, the US and Asia-Pacific (APAC) regions, analysing their ESG supervisory structure, disclosure quality and ESG expertise at board level, and how these factors compare with NN IP’s proprietary ESG performance score. The types of ESG supervisory structures examined in the report include stand-alone board committees, combined board committees, full board ESG oversight, and below-board level committees.

Source: Exploring the links between ESG supervision and performance, NN Investment Partners & Glass Lewis, September 2021

Key findings from the report suggest that:

1. Companies with a stand-alone board ESG committee typically display better ESG performance

Companies with a stand-alone ESG committee at the board level tend to have higher ESG scores than companies with other supervisory structures, such as ESG oversight conducted by the full board, combined board committees, or below-board committees.

2. Stand-alone ESG committees are more common in European and US companies compared to APAC

The report found that 26% and 28% of companies in Europe and the US, respectively, had stand-alone ESG committees compared to 25% of APAC companies. This is likely driven by the mandatory ESG reporting requirements in Europe and the US.

3. The quality of ESG disclosures is higher for companies in Europe compared to the US

Despite Europe and the US having mandatory ESG reporting regimes for companies, the quality of ESG disclosures was found to be substantially higher in Europe than in the US, where many companies appear to be taking a “legal minimum” approach. Interestingly, APAC companies had marginally better ESG disclosures than US companies despite only having a voluntary disclosure regime. This may suggest that APAC companies that voluntarily disclose ESG information tend to provide high-quality disclosures.

4. Companies with ESG oversight below-board had better ESG scores than those with combined committees

Surprisingly, ESG performance for companies with below-board ESG committees exceeded those where ESG oversight was performed by a combined board committee. This may indicate that a stand-alone ESG committee, whether at the board level or below-board, may be more impactful to ESG performance than a combined committee.

5. Companies with poor ESG disclosures had the lowest ESG performance

Companies with poor overall ESG disclosure practices and/or do not disclose their ESG supervisory structure had the lowest ESG scores.

6. Stand-alone ESG committees were most common in sectors with greater exposure to and scrutiny of ESG issues

The prevalence of stand-alone board ESG committees was highest in the energy sector (44%) followed by the materials sector (37%), where the scrutiny of environmental issues and climate change tend to be the highest. Stand-alone ESG committees were least common the in the Healthcare sector (10%).

It is undeniable that companies will continue to face increasing expectations by investors and other stakeholders regarding the management and disclosure of ESG risks and opportunities. This increasing focus on ESG accountability will also enhance the scrutiny on boards’ expertise and role to manage ESG strategy and progress.

For more information on the detail of this report and the in-depth analysis behind the above, please see the report here.

The study covers companies in Europe, the US and Asia-Pacific (APAC) regions, analysing their ESG supervisory structure, disclosure quality and ESG expertise at board level, and how these factors compare with NN IP’s proprietary ESG performance score. The types of ESG supervisory structures examined in the report include stand-alone board committees, combined board committees, full board ESG oversight, and below-board level committees.

Source: Exploring the links between ESG supervision and performance, NN Investment Partners & Glass Lewis, September 2021

Key findings from the report suggest that:

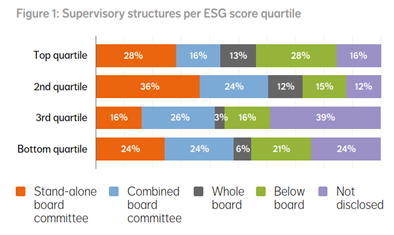

1. Companies with a stand-alone board ESG committee typically display better ESG performance

Companies with a stand-alone ESG committee at the board level tend to have higher ESG scores than companies with other supervisory structures, such as ESG oversight conducted by the full board, combined board committees, or below-board committees.

2. Stand-alone ESG committees are more common in European and US companies compared to APAC

The report found that 26% and 28% of companies in Europe and the US, respectively, had stand-alone ESG committees compared to 25% of APAC companies. This is likely driven by the mandatory ESG reporting requirements in Europe and the US.

3. The quality of ESG disclosures is higher for companies in Europe compared to the US

Despite Europe and the US having mandatory ESG reporting regimes for companies, the quality of ESG disclosures was found to be substantially higher in Europe than in the US, where many companies appear to be taking a “legal minimum” approach. Interestingly, APAC companies had marginally better ESG disclosures than US companies despite only having a voluntary disclosure regime. This may suggest that APAC companies that voluntarily disclose ESG information tend to provide high-quality disclosures.

4. Companies with ESG oversight below-board had better ESG scores than those with combined committees

Surprisingly, ESG performance for companies with below-board ESG committees exceeded those where ESG oversight was performed by a combined board committee. This may indicate that a stand-alone ESG committee, whether at the board level or below-board, may be more impactful to ESG performance than a combined committee.

5. Companies with poor ESG disclosures had the lowest ESG performance

Companies with poor overall ESG disclosure practices and/or do not disclose their ESG supervisory structure had the lowest ESG scores.

6. Stand-alone ESG committees were most common in sectors with greater exposure to and scrutiny of ESG issues

The prevalence of stand-alone board ESG committees was highest in the energy sector (44%) followed by the materials sector (37%), where the scrutiny of environmental issues and climate change tend to be the highest. Stand-alone ESG committees were least common the in the Healthcare sector (10%).

It is undeniable that companies will continue to face increasing expectations by investors and other stakeholders regarding the management and disclosure of ESG risks and opportunities. This increasing focus on ESG accountability will also enhance the scrutiny on boards’ expertise and role to manage ESG strategy and progress.

For more information on the detail of this report and the in-depth analysis behind the above, please see the report here.