25 February 2020

The importance of knowing your investors and how they use ESG rating agencies

Today, companies are more aware than ever of the growing concerns around environment, social and governance (ESG) factors that need to be taken into consideration. The rate of ESG-oriented investing has risen significantly, with sustainable investments now topping over $30 trillion, up 68 percent since 2014 . The evidence is rising and demonstrates that companies who are addressing ESG issues are performing better and reducing downside risk.

In our recent Issues for Companies: ESG Integration publication, we identified how institutional investors are integrating ESG factors into their investment decision making. Increasingly, investors are using ESG rating agencies to peer benchmark companies and understand, at a high level, the ESG exposure of their portfolios. However, with the proliferation of an increasing number of ESG rating agencies and their unique surveys, companies are struggling to keep up with the growing number of survey requests.

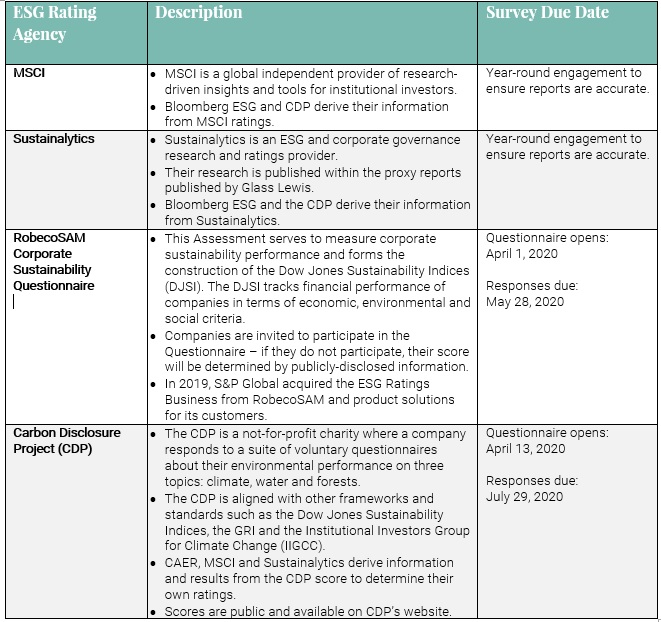

With ESG rating agencies reaching out directly to companies to complete their questionnaires, it is challenging to determine which ones should take priority. For Australian companies, MSCI, Sustainalytics, CDP and RobecoSAM stand out as a few of the most prominent and important ESG “raters”.

The following are definitions of these rating agencies and their respective survey due dates:

Often these rating agencies will reach out to companies and request them to complete their comprehensive, and often time-consuming, questionnaires whilst investors also expect to receive similar information during engagement meetings.

As such, many investors rely on ESG ratings firms to form a critical understanding of how companies integrate ESG in their operations, with the results forming a basis for how ESG is incorporated into their investment and proxy-voting strategies. For some investors, ESG ratings are their only insight into this kind of evaluation, whereas for others, such ratings are an ‘input’ into their own unique ESG analysis.

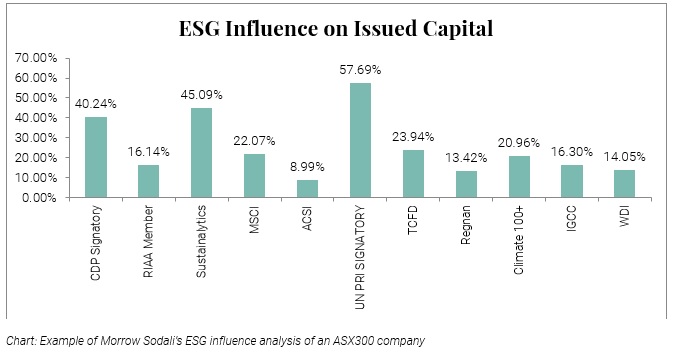

This example graph clearly outlines the level of influence of ESG associations, service providers, rating agencies, and frameworks on a company’s share register.

From conducting an analysis like this, companies can not only prioritize the questionnaires that will make the most impact and therefore avoid ‘survey fatigue’, but also more efficiently direct their engagement with ESG-conscious investors and the ESG rating agencies themselves. Once these parties are identified, companies can provide detailed information to them on a regular basis, ensuring that data is not misconstrued, ultimately improving the accuracy of ratings and reports.

On occasion, the ESG ratings that are produced can be at odds with a company’s own interpretation. As such, there is a push for companies to disclose the information that is collected in these ratings, not only so that the reports are more accurate and reliable, but to properly reflect the company’s own view of its ESG risks and opportunities.

In this way, ESG questionnaires can be viewed as less of a burden but more as another opportunity for companies to own their ESG narrative, rather than relying on ratings to tell their story.

For a broader view on the additional steps issuers should take to effectively deal with shareholder expectations about sustainability across the Australian/Asia Pacific, European and US markets, see our Issues for Companies: Sustainability article.

In our recent Issues for Companies: ESG Integration publication, we identified how institutional investors are integrating ESG factors into their investment decision making. Increasingly, investors are using ESG rating agencies to peer benchmark companies and understand, at a high level, the ESG exposure of their portfolios. However, with the proliferation of an increasing number of ESG rating agencies and their unique surveys, companies are struggling to keep up with the growing number of survey requests.

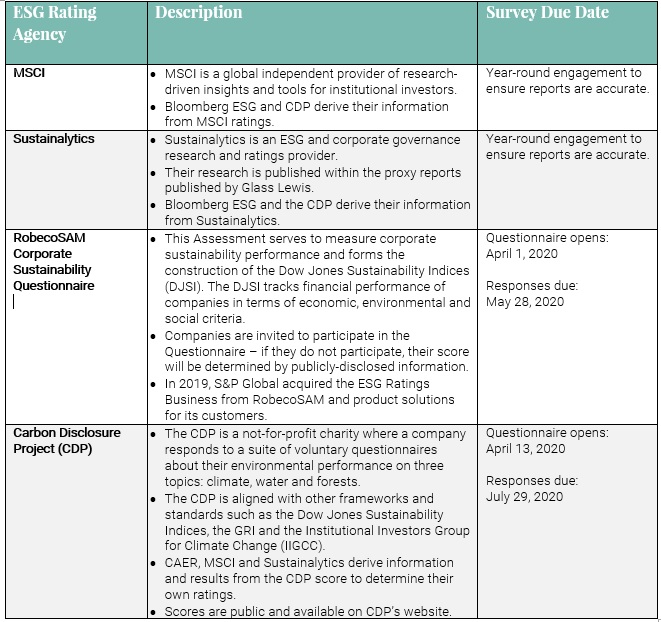

With ESG rating agencies reaching out directly to companies to complete their questionnaires, it is challenging to determine which ones should take priority. For Australian companies, MSCI, Sustainalytics, CDP and RobecoSAM stand out as a few of the most prominent and important ESG “raters”.

The following are definitions of these rating agencies and their respective survey due dates:

Often these rating agencies will reach out to companies and request them to complete their comprehensive, and often time-consuming, questionnaires whilst investors also expect to receive similar information during engagement meetings.

As such, many investors rely on ESG ratings firms to form a critical understanding of how companies integrate ESG in their operations, with the results forming a basis for how ESG is incorporated into their investment and proxy-voting strategies. For some investors, ESG ratings are their only insight into this kind of evaluation, whereas for others, such ratings are an ‘input’ into their own unique ESG analysis.

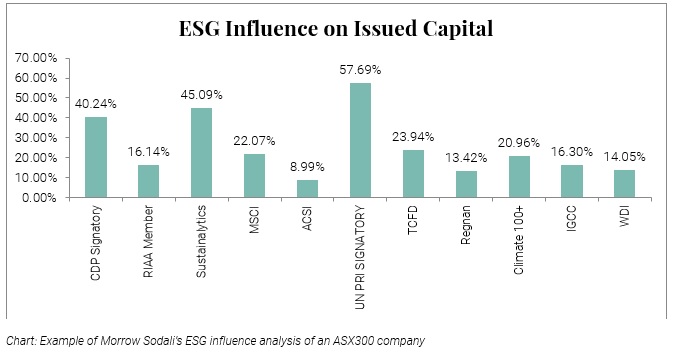

This example graph clearly outlines the level of influence of ESG associations, service providers, rating agencies, and frameworks on a company’s share register.

From conducting an analysis like this, companies can not only prioritize the questionnaires that will make the most impact and therefore avoid ‘survey fatigue’, but also more efficiently direct their engagement with ESG-conscious investors and the ESG rating agencies themselves. Once these parties are identified, companies can provide detailed information to them on a regular basis, ensuring that data is not misconstrued, ultimately improving the accuracy of ratings and reports.

On occasion, the ESG ratings that are produced can be at odds with a company’s own interpretation. As such, there is a push for companies to disclose the information that is collected in these ratings, not only so that the reports are more accurate and reliable, but to properly reflect the company’s own view of its ESG risks and opportunities.

In this way, ESG questionnaires can be viewed as less of a burden but more as another opportunity for companies to own their ESG narrative, rather than relying on ratings to tell their story.

For a broader view on the additional steps issuers should take to effectively deal with shareholder expectations about sustainability across the Australian/Asia Pacific, European and US markets, see our Issues for Companies: Sustainability article.