07 May 2024

SEC Adopts Rules Shortening the Standard Settlement Cycle to T+1

On February 15, 2023, the Securities and Exchange Commission (SEC) voted to adopt rule changes to shorten the standard settlement cycle for broker-dealer transactions in securities from two business days after the trade date (T+2) to one business day after the trade date (T+1). The SEC believes this will “promote investor protection, reduce risk, and increase operational and capital efficiency.”

Summary - The move from T+2 to T+1

In the investment world of stock trading, the settlement process for a trade has gradually narrowed over time. Effective May 28, 2024, the Securities and Exchange Commission will move from the current T+2 settlement (transaction date plus two business days) to a T+1 settlement (transaction date plus one business day). This change shortens the cycle by one day for all U.S. securities transactions. Canadian securities will shift to the new cycle on May 27.

What exactly is the settlement cycle?

The settlement cycle is when the ownership of a stock, bond, or other security transfers from the seller to the buyer. A stock brokerage firm is expected to receive payment from the buyer in the transaction for the assets no later than two business days after the trade is executed.

The history of the settlement process

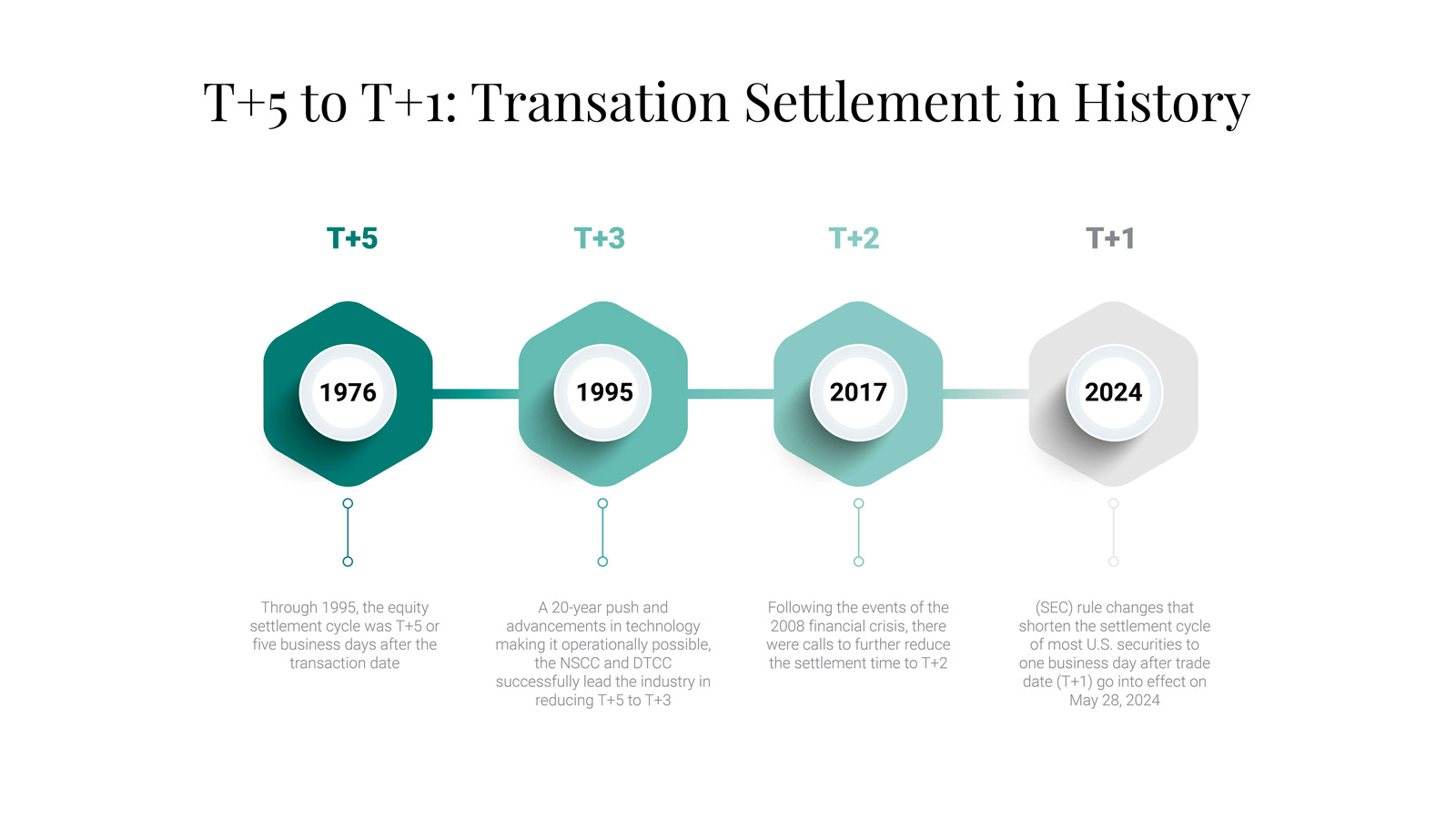

The trade settlement cycle has changed notably since trading at the New York Stock Exchange in 1817. Before digitization, every transaction resulted in the physical delivery of paperwork associated with the trade, ranging from trade tickets to stock and bond certificates, including the exchange of paper currency. This process relied heavily on couriers and the postal service to complete the transactions over a few days, with many of the participants (banks, brokers, and investors) choosing to maintain a physical presence in and around the Exchange to expedite the process. The widespread use of new technology, such as facsimile machines and centralized clearing, resulted in the ability to reduce the settlement cycle in 1993 from five business days to three business days.

The next move to shorten the settlement cycle occurred in March 2017, shifting from T+3 to T+2. Further advances and applications of technology have increased the trading speed to nanoseconds, increasing the risk to thinly capitalized broker-dealers and resulting in a recommendation to shorten the trading cycle to T+1 in February 2023.

Credit in part: SIA Partners

Bigger challenges outside the U.S.

Foreign investors and brokers operating in this system expect challenges associated with foreign exchange when participating in the shorter cycle. Securities lending operations must ensure they can process and expedite the recall of security loans. Under the tighter timeframe, the back-office operations will need to reduce or eliminate slower manual processes and shift their workforce focus to real-time transaction reconciliation. Issuers may experience an increase in the liquidity of their shares, potentially higher trading volume levels, and quicker access to insights on investor movements.

Potential Impacts to Consider

While the expected change yielded numerous benefits for investors and market participants, unexpected changes are almost certain.

Securities Lending and Proxy Voting

The shortened settlement cycle will increase pressure on securities lending. With a shorter settlement cycle, there is less time for securities lending transactions. This could impact securities lending activities and create challenges for market participants engaged in short selling or borrowing securities for other purposes. There may be problems with recalling hard-to-borrow securities with a high level of short interest. If lenders find it necessary to hold back inventory and do not feel that they can lend the full position that they wish to lend, this changes the economics of their lending strategy. This becomes particularly important when considering short interest as a record date for a shareholder meeting. Certain challenges could arise on voting authority when considering shares on loan, impacting the ability to reach a quorum.

Liquidity Impact

There is a potential liquidity Impact, especially for smaller market players. While the expectation is this reduced timing could potentially reduce the amount of liquidity tied up in a trade, as participants have to allocate funds for a shorter duration, the faster settlement cycle may increase the need for liquidity to meet tighter deadlines, and this could have affected specific market segments differently.

Corporate actions and ex-date

Corporate actions generally have an ex-date one day before the record date, enabling more trades to settle in advance of the record date cut-off. With the change to T+1, the ex and record dates will need to be the same day, which will likely cause reconciliation issues.

Smaller Margin Requirement

According to estimates by the Depository Trust & Clearing Corporation (DTCC), T+1 will result in a 41% reduction in the CCEP (Counterparty Credit Exposure Policy) margin. This reduction allows firms to manage liquidity and capital better.

Considerations for Looking Ahead

While T+1 will have taken nearly 15 months from announcement to transition, could a similar time frame be seen for a shift to real-time settlement (otherwise known as T+0)?

According to a Securities Finance Times panel in October 2023, the group noted, “We will not be transitioning to T+0 with our current technology and settlement processes. Something will need to shift before we can support real-time settlement…. I do not look at T+1 settlement as a massive headache for the securities lending industry. T+0 will be a lot more problematic. Significant steps have been made with technology development, but there will be a need for integrated technology development for analytics, through settlement, cash management, books, and records.”

Some speculate that this may be the last chance to accelerate settlement for some time. However, it is worth noting that prior settlement changes were driven primarily by industry leaders. In contrast, these changes are now driven by regulators. In fact, The SEC sees this shift to T+1 as a precursor to future innovations in settlement cycles. The Commission envisions the potential for a T+0 or instantaneous settlement cycle. It actively explores the feasibility of such a paradigm shift, emphasizing its commitment to fostering an agile and efficient capital market ecosystem.

With faster trade settlement, companies must stay closer than ever to the process and keep abreast of emerging trends.