14 May 2024

Conference Overview: RIAA Conference Australia 2024

The Morrow Sodali team brings you the latest from the 2024 Responsible Investment Association Australasia (RIAA), which was held on 1st and 2nd May 2024 in Sydney.

The Responsible Investment Association Australasia (RIAA) 2024 Conference opened with a keynote speech and a panel on how to navigate geo-political risks, suggesting that nine out of ten geo-political risks do not have an impact on individual investment portfolios. But the tenth one almost certainly will, and the most common denominator of many geo-political events that matter points to supply chain disruptions. At the same time, there are events which require individual investors to take action despite not having a direct impact on financial performance, such as armed conflict.

RIAA has developed a Toolkit on ‘Human rights violations in the context of armed conflict’, with detailed guidance for investors to identify where portfolio companies may be operating in a conflict-affected context, how to identify actual and potential adverse human rights impacts, and how investors can engage with companies on these issues, including the supply chain risk management.

Suppliers were also the key focus group on other panels, with one specifically relating to modern slavery. The statistics are stark - there are around 50 million people worldwide treated as slaves, out of which 60% reside in the APAC region. A total of 70% of Australian trade is within the APAC region, so the risk of modern slavery for many businesses in Australia is high. In addition, approximately 41,000 are in Australia, predominantly in cleaning, private security, agriculture, and entertainment industries. Yet only 2% of companies report instances of modern slavery. The panel argued that the current legislation is very much focused on compliance and not on action, and that a more integrated approach involving broader human rights issues would be much more effective. They also pointed out the importance of peer benchmarking and acknowledging wide-spread risks across sectors and regions as a matter for consideration in companies’ disclosures.

Two companies were highlighted as standouts in how they address modern slavery risk – Woolworths as identifying suppliers with slave-like conditions and addressing root causes, and Seek.com with its ‘Fair Hiring initiative’, which aims to identify red flags in job ads that could lead to modern slavery.

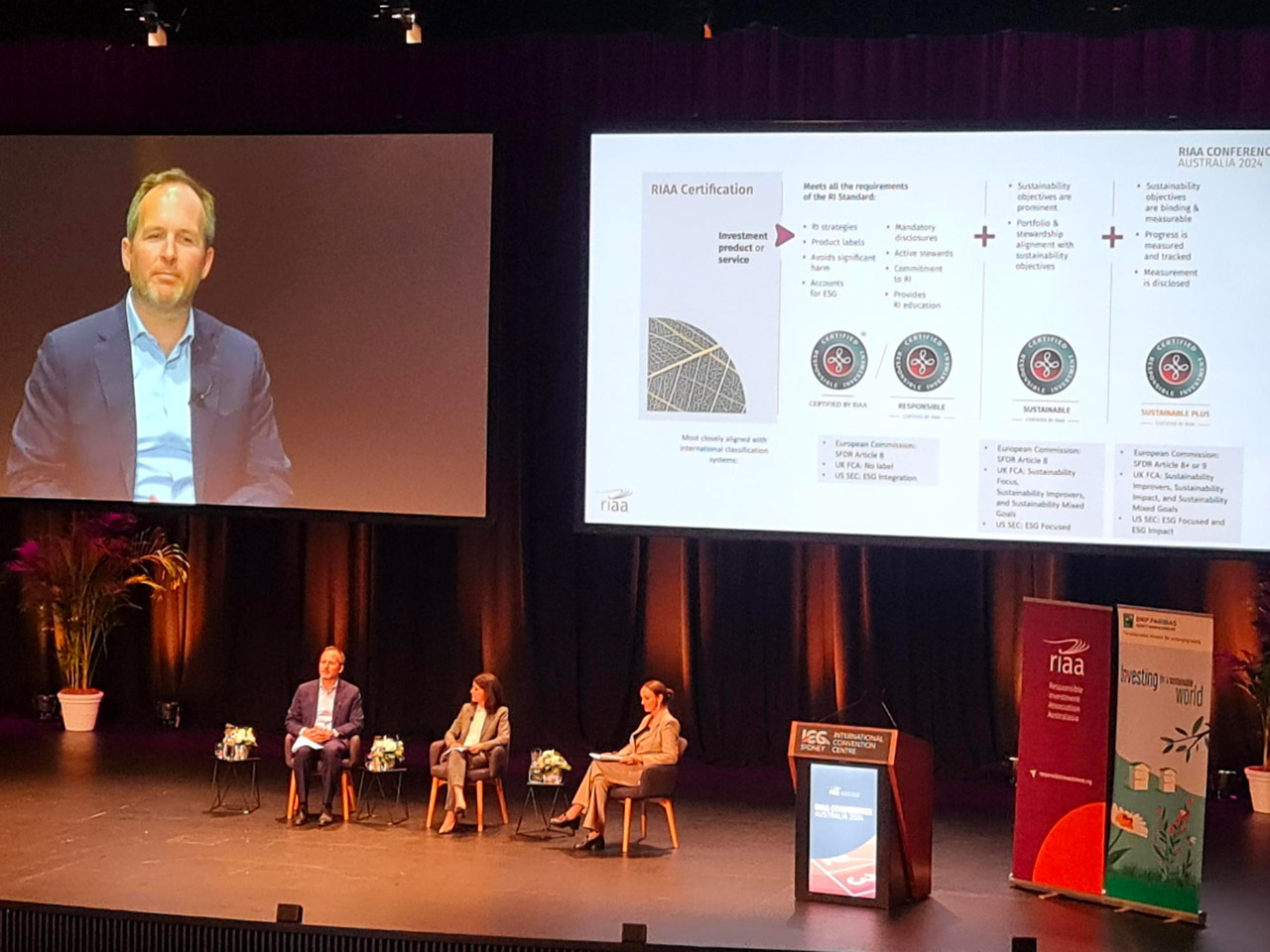

The RIAA Conference 2024 also marked the launch of the RIAA’s Sustainability Classification initiative, introducing a new certification system for investment products and services. The Classification comprises of three categories:

- Responsible (in line with SFDR Article 8; and US SEC ESG Integration),

- Sustainable (in line with SFDR Article 8; US SEC ESG Focused; and UK FCA Sustainability Focus, Sustainability Improvers and Sustainability Mixed Goals), and

- Sustainable Plus (in line with SFDR Article 9; SEC ESG Focused and ESG Impact; and UK FCA Sustainability Improvers, Sustainability Impact and Sustainability Mixed Goals).

The main objective of the classification and certification system is to reduce the risk of greenwashing associated with financial products and services. Day 2 kicked off with this topic at large, with a keynote speech by ASIC Chair Joe Longo. ASIC so far issued 17 infringement notices, totalling more than $230,000, mainly due to net zero claims made without a reasonable basis or for being factually incorrect, using ‘carbon neutral’, ‘clean’ or ‘green’, that wasn’t founded on reasonable grounds, the overstatement or inconsistent application of sustainability-related investment screens, and the use of inaccurate labelling or vague terms in sustainability-related funds.

On RIAA’s radar were also the challenges associated with sustainability strategies and reporting at the corporate level. The fireside chat with Alison Taylor, Clinical Associate Professor at New York University Stern School of Business, confirmed that sustainability officers usually have no or limited budget, have very little authority within the organisation, and have almost no involvement in strategy, capital allocation, governance and other important aspects. A research paper on ‘The evolving role of chief sustainability officers‘ revealed that the shift to a more central role for CSOs is most dramatically revealed in companies undergoing major business transformations in response to existential challenges. The definition of what a CSO does is also not consistent. The assumption is that it involves engagement with stakeholders, but stakeholders almost never interact with the CSO.

Correspondingly, the following panel on net zero energy transition with BHP’s Climate and Sustainability Officer, Fiona Wild on the panel, delved deeper into these and other challenges that many CSOs and other executives face. Amongst the most relevant ones for BHP, Fiona cited the gap between market expectations regarding progress on climate change and reality on the ground – in that people want to see a linear reduction of emissions year on year, but the emissions are extremely lumpy and do not always move in a linear way even if the company’s investments are there and potentially increasing. This leads to very difficult conversations with investors and other stakeholders.

In a heated debate about carbon offsets on another panel, the panellists questioned the effectiveness of offsets in assisting with decarbonisation. The demand for cheap credits is high - the cheaper the offsets, the easier it is to pursue a strategy where emissions go up, rather than a strategy requiring emissions avoidance or reduction. In addition, the most popular carbon offset project type in Australia is human-induced regeneration (HIR) of forests. One of the panellists argued that the majority of these projects ‘generating’ credits are practically worthless because they relate to land where vegetation has never been cleared from, thus the forest is very unlikely to regenerate.

The panel titled What is ‘nature positive’ anyway? Also touched on deforestation and reforestation, but focused mainly on the increased scrutiny companies face with regard to their impact on nature and biodiversity.

.jpg)

Nature – the natural world, emphasising the diversity of living organisms, including people, and their interactions with each other and their environments.

Biodiversity – refers to the variability among living organisms across these realms.

Nature positive – a global societal goal defined as ‘Halt and reverse nature loss by 2030 on a 2020 baseline, and achieve full recovery by 2050’. Protect what is left and improve the rest.

The panel referred to the Kunming-Montreal Global Biodiversity Framework, somewhat of a ‘Paris Agreement for climate’, signed by 196 countries in 2022, including Australia. The Framework is made up of 4 global 2050 goals and 23 global 2030 targets. The Framework’s action agenda includes:

- Halting extinction of known threatened species and significantly reducing extinction risk,

- Effective restoration and effective conservation and management of at least 30% of areas of degraded terrestrial, inland water, and coastal and marine ecosystems,

- Reducing pollution risks, and

- Minimising the impact of climate change and ocean acidification on biodiversity

The panel argued that achieving the biodiversity goals is about contribution not attribution, with focus on stewardship, regeneration, commitment and cultural resonance. Speakers also highlighted the role that Native Title plays in this area as well as noting the first attempts to develop a framework for natural capital accounting, with Nuveen cited as the leader.

The panel on disability, equity and inclusion revealed that 18% of the population in Australia have a disability and that people with disabilities who are perfectly qualified and willing to work face enormous barriers to being offered a job. This is partly due to the fact that most leaders are not prepared to acknowledge disability and that most companies don’t collect data on disability. But recent research from Accenture showed that companies that lead in disability inclusion outperform their peers on financials. Additionally, individual costs associated with changing or redesigning the processes are actually minimal.

AGL, represented on the panel by their head of Legal, signed up to Valuable500, a global movement putting disability inclusion on the business leadership agenda, and also started AGLAbility Network, an internal space for all AGL employees to collaborate and discuss disability inclusion, supported by the AGL Ability Committee.

A total of 22 investors, predominantly based in North America, signed a joint statement on corporate disability and inclusion, with CalSTRS and the New York City Comptroller leading the way in using disability metrics as a way to identify stocks to invest in.

Deanne Stewart, the CEO of Aware Super, did not highlight disability as a specific topic in her keynote, however, quantifying the ‘S’ in the ESG is high on the agenda for the fund, as well as climate change, and specifically asking companies to put their Climate Plans up for a vote.

A few panels were asked about the ESG backlash in the United States, with one putting it into contrast with the situation in Europe, where the approach is completely reversed and mandated by the EU legislation. The panellists argued that in Europe, being part of the transition is part of a company’s licence to operate. The ‘movement’ has been largely investor and asset owner driven, so the focus has always been on value creation, not ‘woke-ism’. But it was disclosure requirements that made a lot of people on the investment side start to take it seriously.

Overall, the conference covered a wide range of responsible investment themes, reiterating the importance of education - about the risk of greenwashing, data and disclosure, the need for collaboration and stewardship, and the importance of culture and hardwiring sustainability into day-to-day operations.

But the key messages that underpinned the two days were (1) Energy transition is a big ship that needs to turn, and it can’t sink in that process, and (2) Divestment is not the answer. After all, as one speaker quoted, ‘where there is light, there is action’.