18 October 2023

An Evolving Landscape of ESG in China

Over the last few years, the Chinese market has been undergoing an increasingly more visible transformation in terms of its commitment to ESG. Morrow Sodali recently participated in a series of events in China, observing a number of factors driving this change, including increased regulatory responses, implementation of new reporting standards and improved disclosures. Morrow Sodali's Manager, Corporate Governance, Fang Yuan explains.

Regulatory action is accelerating improvements in the ESG ecosystem

China is undergoing a noticeable change in its commitment to ESG that is being reflected in everyday language and commonly used phrases. A few examples include "Clear waters and green mountains", which suggests that ‘Clear waters and green mountains are as valuable as gold and silver mountains’; "Dual carbon goals", meaning ‘Peaking carbon emission by 2030 and achieving carbon neutrality before 2060’; or "Commitment to harmony between human beings and nature". These, and many other subtle elements influencing everyday actions, point out the direction of regulatory change.

Perhaps the most significant impact of regulatory action in China has been the lifting of 800 million people out of poverty over the last 40 years. China’s success relied mainly on two pillars: rapid economic growth supported by broad-based economic transformation, which provided new economic opportunities for the poor and raised average incomes; and government policies to alleviate persistent poverty, which initially targeted areas disadvantaged by geography and a lack of economic opportunities, but subsequently focused on poor households, irrespective of their location. While this process started years before the concept of ESG became mainstream, it is very much aligned with the intent of the United Nations' Sustainable Development Goals (SDGs) which, amongst other things, aim to ‘end poverty in all its forms everywhere’.

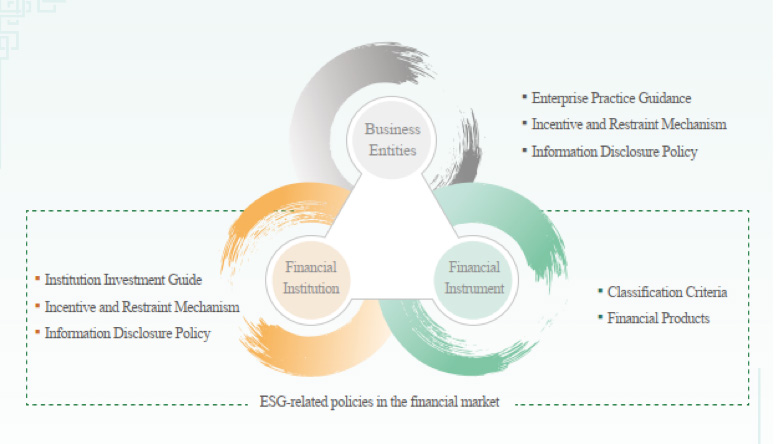

Although Chinese ESG-related regulations arrived relatively late compared to many other countries, they have developed rapidly in the past few years. Some of the more recently implemented policies include high-level guidance, implementational guidelines and incentives covering business entities, financial institutions, and financial instruments (see Figure 1 below). Business entities are targeted as the main drivers to advance ESG practices, mainly via the development of innovative and sustainable products and services.

Figure 1. China's ESG-related policy framework (China Central Depository & Clearing Co., LTD. and International Capital Market Association)

Financial entities are targeted for their ability to influence businesses to enhance their ESG performance by embedding ESG into investment decision processes and through engagement. This targeting was evident in early 2012, when the Central Government issued Guidelines for the banking and insurance sectors to incorporate ESG requirements into their risk assessment systems.

In 2016, seven state ministries jointly issued Guidelines for Establishing the Green Financial System, which was approved by the State Council, the People's Bank of China, the Ministry of Finance, the National Development and Reform Commission and many other government bodies. The Guidelines include a series of policy incentives and emphasise the development of green bonds and green insurance, striving to accomplish many essential goals, including:

- Vigorously developing green lending

- Enhancing the role of the securities market in supporting green investment

- Launching green development funds and mobilising social capital through Public and Private Partnerships (PPP)

- Developing green insurance

- Improving the environmental rights trading market and developing related financing instruments

- Supporting local government initiatives to develop green finance

- Promoting international cooperation in green finance, and

- Preventing financial risks and strengthening implementation

In 2019, the China Trustee Association issued its Green Trust Guidelines, which aim to drive sustainable asset management products. Since the first ESG bond came to market in 2015, China has become a significant player in the world's green bond market and now it is one of the largest issuers globally. These bonds follow international standards such as the International Capital Market Association's Green Bond Principles and require issuers to use 100% of the proceeds on environmental protection projects. As of 2022, 41 ESG-themed bonds had been issued, with a value of over 12 billion Yuan (USD 1.64 billion). With the central government firmly committed to achieving its carbon goals, and implementing its policy commitments through the "Carbon peak and Carbon neutrality framework", the end result is that environmental-focused bonds currently account for 90.2% of all of the E, S and G bonds issued.

The China - EU Common Ground Taxonomy (CGT) report marks another milestone in the evolution of China's ESG ecosystem. This 2021 report, co-authored by the International Platform on Sustainable Finance (IPSF) Taxonomy Working Group, and co-chaired by the European Commission and People’s Bank of China, was a technical comparison between the taxonomies of the EU and China. It thoroughly compared commonalities and differences between the taxonomies. The CGT report analysed 79 activities across six sectors, including:

- Agriculture, forestry, and fishing

- Manufacturing

- Electricity, gas, steam and air conditioning supply

- Water supply, sewage, waste management and remediation activities

- Construction

- Transportation and Storage

The CGT report intends to scale up the mobilisation of green capital internationally and provides a reference for other taxonomies to compare to in the future.

In 2022, China unveiled its inaugural ESG reporting framework - the Guidance for Enterprise ESG Disclosure. This voluntary ESG disclosure framework was set by a State Council supervised body, the China Enterprise Reform and Development Society, in collaboration with Chinese corporations identified as having high ESG risks within their respective sectors. The guideline is regarded as China's locally adapted ESG framework with a scientific and measurable data-based evaluation system. It comprises three first-level indicators (E, S and G), ten second-level indicators, 35 third-level indicators and 118 fourth-level indicators.

Stock Exchanges are active in driving a climate-related ESG disclosure framework. In April 2023, the Stock Exchange of Hong Kong Limited (HKEX) published a consultation paper seeking market views on proposals to mandate all issuers to make climate-related disclosures in their ESG reports, and to introduce new climate-related disclosures aligned with the ISSB Climate Standard (IFRS S2). "Our proposal aims to accelerate the building of resiliency and the sustainability journey of our issuers, further strengthening Hong Kong's position as a trusted and attractive venue for capital raising", stated HKEX's Head of Listing.

The Shanghai Stock Exchange also now encourages listed companies to disclose ESG information, and all listed companies in the STAR market (the Science and Technology Innovation Board) have been required to disclose ESG information in their annual reports (beginning in 2022). As China has pledged to hit peak carbon emission before 2030 and achieve carbon neutrality by 2060, the Shanghai Stock Exchange has also stressed that companies should disclose their sustainable development plans in alignment with the 30-60 goals.

State-Owned-Enterprises (SOE) are the main vehicles driving quality ESG reporting

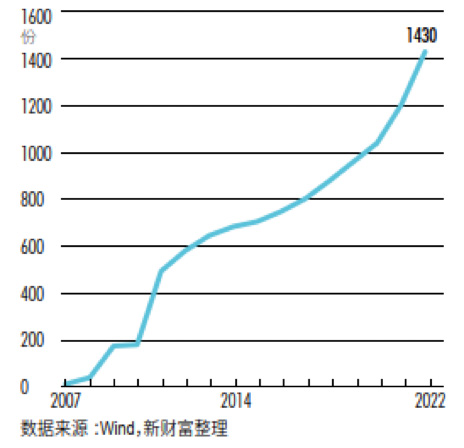

Each year, an increasing number of Chinese companies are publishing ESG, corporate social responsibility (CSR) or sustainability reports. In 2022, 28% of Chinese A-share corporations issued ESG-related reports. Of these reports, 80% were branded as CSR reports (see Figure 2.)

Figure 2. Wind, New Fortune survey shows 1419 A-share companies published 1430 ESG reports, of which 11 companies released dual reports of CSR and ESG reports.

The reported issuers were mainly from energy-intensive industries such as petrochemicals, building materials, steel, etc. And the majority of reported issuers are SOE. By April 2023, 70.4% of State-Owned listed companies issued independent ESG reports, and these reports were more detailed when compared to other A-share listed companies.

However, small-to-medium sized companies appear to be struggling with the quality of their reporting due to their concerns about the cost.

Zooming in on the published content, the disclosure of environmental information has been increasing over time, and the depth of governance information has also continued to improve, according to China Central Depository & Clearing Co. Ltd (CCDC).

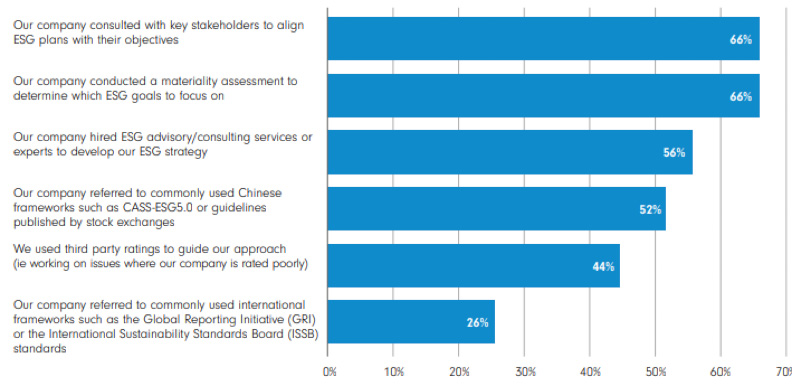

Increasingly, Chinese companies are developing ESG strategies and plans incorporating materiality assessment methodologies or more sophisticated tools. Global asset manager Fidelity surveyed 262 executives from Chinese listed companies to provide “a snapshot of the evolution of ESG strategies in China, perceived areas of progress, plans and programmes that Chinese listed companies are implementing today, as well as their intentions for future transformation.”

More than half (53%) of companies surveyed have publicly announced an ESG or sustainability strategy, while close to 30% of them say they are addressing sustainability issues internally. Two-thirds (66%) of organisations said they had consulted with their key stakeholders to align their ESG plans with their own objectives (see Figure 3).

Figure 3. Economist Impact ESG survey of publicly listed companies in China (December 2022—January 2023)

The number of responsible investment institutions in China is on the rise

By the end of 2021, 83 Chinese institutions had signed up to the United Nations Principles for Responsible Investment (UNPRI), rising from just nine in 2016. The signatories are asset owners, investment managers and information service providers. The PRI requires signatories to incorporate ESG into their investment analysis.

Separately, 13 Chinese and UK financial institutions have joined the UK-China Climate and Environmental Information Disclosure Pilot Program in accordance with guidelines from the People's Bank of China and the Bank of England for environmental-related information disclosure.

International institutional investors are increasingly embedding ESG into their investment decision-making processes. Flora Wang, Head of Stewardship APAC at Fidelity notes: “We apply the same approach to our investments in China, which allows us to have in-depth conversations with our investee companies on sustainability issues that are material to their long-term development.”

Fidelity’s approach to sustainable investing integrates ESG into defining the investment universe, selection of securities for portfolio construction, voting and engagement.

Fidelity has reported that local investors are becoming more active and willing to express their opinions through voting and engagement, putting the market on the right track to continuing ESG advancement. Data from Fidelity indicates that the average voter turnout among minority shareholders climbed to 27.5% in 2021, from 26.2% in 2019, despite the difficult backdrop of the Covid-19 outbreak and related travel restrictions. Fidelity’s report also points out that minority shareholders can still have an ESG impact on a company's ESG strategy, even when many Chinese companies have controlling shareholders.

Another institutional investor giant, BlackRock, actively integrates ESG into its portfolio analysis and has developed a series of ESG funds in China. These include the China Environmental Tech Fund and the China Impact Fund, which aim to invest assets to address China's social and environmental problems.

Summary

In summary, the concept of ESG is developing rapidly in China with supportive regulations, more responsible investors, proactive ESG practitioners and the increasing prevalence of ESG thematic funds in the Chinese market. Morrow Sodali is pleased to see local Chinese issuers playing a vital role in this ESG evolution and is looking forward to assisting companies on their journey.

For more ESG advisory enquiries, please contact:

Raymond Chen, Managing Director, Hong Kong and Mainland China, r.chen@morrowsodali.com

Jana Jevcakova, Managing Director, Head of ESG International, j.jevcakova@morrowsodali.com

Justin Grogan, Senior Managing Director, Corporate Governance and Sustainability APAC, j.grogan@morrowsodali.com

Fang Yuan, Manager, Corporate Governance and Sustainability, f.yuan@morrowsodali.com